A New Era for the Economy Creates Uncertainty

September Recap and October Outlook

The outcome of the Fed’s meeting in September was to hold rates at the current level. It has been described as a “hawkish pause,” and the Fed was clear in post-meeting remarks and statements that one more increase is still possible in 2023.

Regarding the impact on the economy, markets, and consumers, a terminal rate that includes one more increase likely is less important than the messaging that rates will be higher for longer. Fewer cuts next year will mean pressure on businesses and consumers, and with inflation still at twice the Fed’s preferred level, the impact of this new reality is unknown.

The post-2008, pre-pandemic era of low rates, low inflation, and ever-expanding values is firmly in the rearview mirror. The term for what we’re seeing now is “high-pressure equilibrium,” where low unemployment and positive growth co-exist in tension with inflation that is above the Fed’s long-term target of approximately 2%.

Let’s get into the data:

- Consumer spending dropped vs. last month. The Commerce Department reported personal incomes rose 0.4% in August, while consumer spending rose 0.4%. This is a decrease from July’s bump of 0.8%

- GDP expectations were revised up. The Federal Reserve now expects 2023 GDP to increase 2.1%. In June, this number was 1.0%

- The personal savings rate rebounded a bit in August. The Bureau of Economic Analysis reported a 3.9% rate

- The average 30-year fixed mortgage rate hit 7.53% at the end of September, according to the Mortgage Bankers Association

What Does the Data Add Up To?

A soft landing for the economy looks increasingly possible, but the economic plane doesn’t seem to be landing in the same country it took off from. For the first time since the recovery after the Global Financial Crisis really took hold, we may be seeing a lasting change that results in a new cycle.

If the Federal Reserve maintains the higher-for-longer position on interest rates, it will begin to have lasting implications. The FOMC meeting’s Dot Plot of expectations for interest rates in 2024 showed an expected rate of 5.1%, up from 4.6% in June 2023. This implies two interest rate cuts instead of the four that were previously expected. Much tighter money supply over a longer period of time will likely result in pressure on companies that rely on infusions of capital to fund day-to-day operations as well as growth.

As we face what could be a new economic reality, we see a consumer who has apparently reached the end of the excess savings accumulated during the pandemic. The Federal Reserve Bank of San Francisco recently calculated that excess savings (defined as savings beyond what might be expected based on pre-pandemic trends) peaked in August 2021 at $2.1 trillion. This number had declined to less than $190 billion by the second quarter of 2023. However, Fed economists aren’t the only ones analyzing this data; other results aren’t as dire.

The reason savings matter is that consumer spending fuels the economy. It accounted for 68.3% of GDP as of June 2023, according to the Federal Reserve Board of St. Louis. A consumer without excess savings to spend may curtail expenditures, putting downward pressure on the economy. So far, this hasn’t happened. But with the credit card balances topping $1 trillion, the cost to consumers of the ongoing spending spree is going up.

Besides business and personal balance sheets, another area of vulnerability is heightened uncertainty. A government shutdown was barely avoided at the end of September, and the short window to get an agreement on spending is beginning with chaos following an unprecedented defenestration of the House speaker.

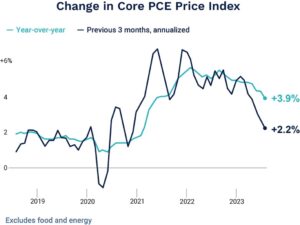

The Personal Consumption Expenditures Index Is Telling a Positive Story

The Federal Reserve prefers to look at the PCE Index rather than CPI. PCE shows a normalizing in inflation levels over the last three months.

Source: U.S. Bureau of Economic Analysis. Chart: Axios Visuals

Equity Markets in September

- The S&P 500 was down 4.87%

- The Dow Jones Industrial Average fell 3.50%

- The S&P MidCap 400 declined 5.42%%

- The S&P SmallCap 600 was down 6.16%

Source: S&P Global. All performance as of September 30, 2023

The received wisdom about the equity market is that it hates uncertainty, but it doesn’t seem too keen on Chairman Powell’s efforts to convey how certain the Fed is that rates will not be going down soon. After a strong recovery from the bottom of the market on October 12, 2022, it was looking possible that a new bull market had begun. With another month of declines, the bear may not be ready to hibernate yet.

Ten of eleven sectors declined over September, and as of September 29, 499 issues had reported, with 76.2% beating estimates on earnings.

Bond Markets

The 10-year U.S. Treasury ended the month at a yield of 4.58%, up from 4.11% the prior month, reflecting the market’s move to “risk off.” The 30-year U.S. Treasury ended September at 4.71%. The Bloomberg U.S. Aggregate Bond Index returned -2.54%, with a year-to-date return of -1.20%.

The Smart Investor

A new cycle means that it’s a good time to review your balance sheet and your financial goals with your Financial Service Group advisor. There are a lot of actions that can be taken to help ensure you remain on track.

As we head into year-end, you’ll also want to think through any moves you need to make before December 31. Are you maxing out your 401(k)? If so, have you considered temporarily adjusting your allocation so you minimize market risk? Are you making a charitable donation? Where will the funds come from? The answer may be different now, considering declining market values over the last several months.

Thinking through your plan and tackling issues one step at a time is key. If the bear is going to continue to growl, you want to be prepared.

***************************************************

This work is powered by Advisor I/O under the Terms of Service and may be a derivative of the original. The information contained herein is intended to be used for educational purposes only and is not exhaustive. Diversification and/or any strategy that may be discussed does not guarantee against investment losses but are intended to help manage risk and return. If applicable, historical discussions and/or opinions are not predictive of future events. The content is presented in good faith and has been drawn from sources believed to be reliable. The content is not intended to be legal, tax or financial advice. Please consult a legal, tax or financial professional for information specific to your individual situation.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Financial Service Group, Inc. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.