Are we in the late stages of a bull market—that time when the market suddenly takes off like a rocket for no apparent reason?

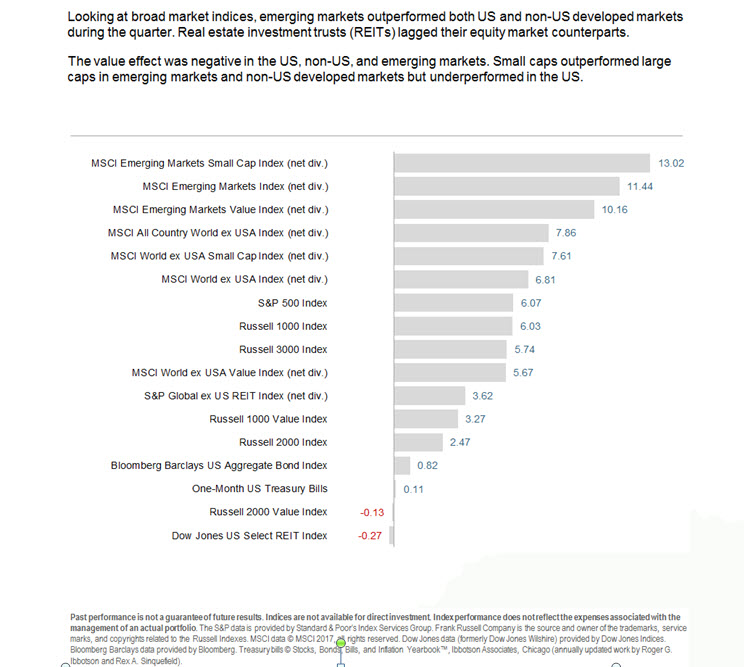

Over the last eight years, the S&P 500 index has returned more than 300%. But the tail end of this run seems to have accelerated the trend. The first quarter of 2017 provided the highest returns for U.S. large-cap stocks since the last three months of 2013. The Nasdaq index has booked its 21st record close of the year so far, and the indices have recorded a 30% rise over the past six quarters, marking the fastest advance since 2006.

The pundits on Wall Street have been telling us that the market’s sudden meteoric rise—which really accelerated starting in December of last year—is the result of the so-called “Trump Trade,” shorthand for an expectation that companies and individuals will soon be paying fewer taxes and be burdened by fewer regulations, leading to higher profits and greater overall prosperity. Add in a trillion dollars of promised infrastructure spending, and the expectation is an economic boom across virtually all sectors.

However, the latest reports show the U.S. gross domestic product—a broad measure of economic activity—grew just 1.6% last year, the most sluggish performance since 2011. The U.S. trade deficit widened in January, and both consumer spending and construction activities are weakening from slower-than-average growth rates.

The good news is that corporate profits increased at an annual rate of 2.3% in the fourth quarter, which shows at least incremental improvement. However, the previous three months saw a 6.7% rise in profits, suggesting that the trend may be downward going forward.

In the coming months of this new Administration there is sure to be more talk of healthcare legislation. There will almost certainly be a tax reform debate in Congress. We know that the President and Congress want to lower corporate tax rates and simplify the tax code. We know that there is general opposition to any form of estate taxes, but we don’t yet know which deductions would be eliminated in order to make this package revenue-neutral.

Similarly, we haven’t seen any details about the promised infrastructure package and we have no idea if whatever is ultimately proposed will receive bipartisan support.

We can, however, be certain of one thing: as the bull market ages, we are moving ever closer to a period when stock prices will go down, perhaps as dramatically as 20%, which would qualify as a bear market. This is a good time to ask yourself: how much of a downturn would I be able to stomach before panic sets in? If your answer is less than or close to 20%, this might be a good time to revisit your stock and bond allocations.

On the other hand, if you’re not fearful of a downturn, then you should look at the next bear market the way the most successful investors do, and envision a terrific buying opportunity, a time when stocks go on sale for the first time in the better part of a decade. For some reason, people go to the shopping mall to buy when items go on sale, and do the opposite when the investment markets go down. Knowing this can be an unfair advantage to your future wealth, and even make you look forward to the end of this long, unusually steady, increasingly frantic bull run in stocks. After all, if history is any indication, the next downturn will be followed by another bull run.